Charges of investing in NPS

We all know that NPS is one of the best choices for many to invest for their retirement and also to save on tax. You have to decide whether you wish to invest in it or not. However, in this post, let me share the charges of investing in NPS (specially for investing through PoPs) as many people think that PoP charges are also cheap like NPS!!

Charges of investing in NPS – Is it cheap. Really!!

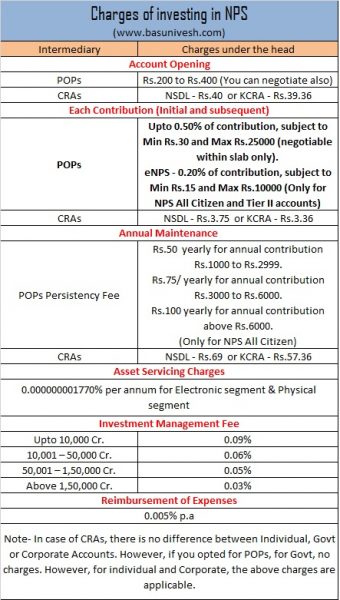

You might have heard that NPS is one of the least charging products in India. When someone says so, they are pointing to the fund management charges only. However, they ignore or wisely do not share the other charges of investing in NPS. The below table will give you the complete picture of the current cost of investing in NPS.

You noticed that if you are trying to open the account and managing it through POPs, then the cost is much higher from the beginning itself. The account opening charges vary from Rs.200-Rs.400. However, in the case of CRAs, it’s just around Rs.40.

Same way, the biggest game changer in the case of cost between POPs and CRAs is the charges for each contribution. In the case of CRAs, it is meager (Rs.3.36 to Rs.3.75). But in the case of POPs, it is 0.5% for each contribution (0.2% in the case of eNPS) subject to the maximum and minimum limit mentioned above. This seems to be the costly and huge differentiator when it comes to investing in NPS through CRAs and POPs.

Along with that, both CRAs and POPs charge annual charges (in the case of POPs, it is called PERSISTENCY charges). Here, the charges of POPs are based on your yearly contribution. However, in the case of CRAs, it is fixed without considering how much you charge.

Hence, what I am trying to highlight here is that these charges many ignore or do not share and just quote fund management charges (shared above).

As per the UTI AMC FAQs on NPS, the total charges of NPS are around 0.21% but not just 0.03% to 0.09% fund management charges. This seems to be equal or in fact more if you compare the available few Index Mutual Funds or ETFs. But the only differentiator is, in the case of NPS, your debt and equity are combined. However, if you do it on your own, then you have to choose the different products.

If you or your employer opened your NPS account through POPs, then it cost you more than having an account with CRAs.

What about NPS Retirement Advisers Fee?

“Retirement adviser” means any person being an individual who desires to engage in the activity of providing advice on National Pension System or other pension scheme regulated by Authority to prospects/subscribers or other persons or group of persons and is registered as such under these regulations.

Retirement Adviser can charge three type of fees from the subscribers

to whom he/she has given retirement advise as per regulations and these

fees are

i) Onboarding charges – Rs.200 /- (Max.) on completion of onboarding/registration of subscriber and generation of PRAN.

ii) Subsequent transaction charges – minimum Rs.20 per transaction and maximum Rs.100/- per annum.

iii)

Advisory fee – 0.02% of AUM subject to a minimum of Rs. 100/- and a

maximum of Rs. 1000/- per annum, for providing advice to the

subscribers.

Now, these are the upfront charges of Retirement Advisers. However, if they have an association with POPs, then you have to bear the two costs. One is the cost of a Retirement Adviser and the other cost is the POPs. Hence, before taking advice from such Retirement Advisers, check whether the adviser is associated with POPs or suggests you open the eNPS account directly.

In fact, it is clearly mentioned that RAs have to inform them about their tie-ups with the PoPs to the prospective subscribers. However, how many do it is up to them.

To be a retirement adviser, one is to be a graduate with NISM certification. However, this certification requirement is exempted for SEBI Registered Investment Advisers. Hence, your SEBI RIA (like me) may claim to be not associated with any selling of securities (which comes under SEBI) but maybe act like middlemen for your NPS.

One more undisclosed earning to them MAY be that if such RAs associate with certain POPs, then they may give commission from some % of POPs charges (as there are no such rules from PFRDA that one can’t pass the benefit to RAs).

Considering all these above facts, I personally feel, that having an account with CRAs is a far better option for you than POPs. Above that NPS is not such a complicated product to handhold you or force you to associate with NPS up to your retirement (as the product feature itself illiquid in nature).

I am not a fan of NPS but if someone is willing to save some additional tax, then you may opt for a yearly Rs.50,000 contribution or if your employer is contributing. Otherwise, better to avoid such products. However, many sellers promote this mainly with the taglines like – WORLD’s cheapest pension product, Govt Scheme or Tax Saving product. But ignore the NOISE and listen to your own plan.

If you like this article and found useful, Share with your friends !!

Upcoming: Tax Benefit for electric vehicle purchase loan